INCOME-PRODUCING INVESTMENT REAL ESTATE

MULTI-FAMILY | MEDICAL / OFFICE | SINGLE TENANT | MIXED-USE | SIMILAR

FOR THOSE OF YOU CONSIDERING DIVERSIFYING BEYOND STOCKS AND BONDS, 能产生收益的网赌正规真人实体在线平台是所有认真的投资者都应该评估和考虑的资产类别.

尽管我们的许多/大多数客户更偏重于创收投资网赌正规真人实体在线平台, 我们客户的“典型”资产配置包括投资网赌正规真人实体在线平台的组合, stocks, bonds, gold (other inflation hedges) and alternative investments (hedge funds, private credit, private equity, alt funds, art, wine, fine jewelry and more).

WHY INCOME-PRODUCING INVESTMENT REAL ESTATE?

在美国,网赌正规真人实体在线平台是积累财富和增加净值的最快、最安全的方式之一. To be clear, 我指的是现金流正的出租物业(不是每月从你口袋里掏钱的网赌正规真人实体在线平台)。.

有大量资料表明,大约90%的百万富翁是通过网赌正规真人实体在线平台获得财富的.

但在股市上过度投资的高净值人士数量惊人. Some associate real estate with risk or complexity. 对许多人来说,股票似乎不那么令人生畏,因此更容易违约.

But the fact is that bear markets emerge every 3.平均5年-每次熊市平均损失35%的价值. 住宅和创收投资网赌正规真人实体在线平台是抵御高度重复的熊市周期的合理对冲. 这是另一个你应该在投资组合的引擎盖下点火的重要气缸.

If you’d like a dramatic example of that reality, look no further than the latest bear market beginning in early 2020. Coincidental with more than two years of stagnant stock performance, 住宅网赌正规真人实体在线平台经历了可以想象到的最不寻常的投资压力测试之一, courtesy of the COVID crisis.

Despite federal, state, and local governments across the U.S. barring landlords from evicting tenants for non-payment of rent, rent collections measured consistently between 94.9% to 95.8% throughout COVID compared to a pre-pandemic average of 96%. During this period residential rents went up. Residential real estate values went up. And correspondingly, the net worth of residential real estate investors went up, all during a time many viewed as apocalyptic.

与任何投资领域一样,创收投资网赌正规真人实体在线平台也会受到周期的影响. But its cycles often run counter to stock market cycles, adding to its value as a protective hedge for your portfolio.

投资收益型网赌正规真人实体在线平台主要有7个原因:

List of Services

-

1) Passive Cash FlowItem Link List Item 1

Tenants pay rent. After expenses, what you have left over is passive cash flow. 真正积累财富的是创造与你的时间无关的多种收入来源. 这是网赌正规真人实体在线平台投资与股票投资的区别. Typically, 股票投资者只有在卖出股票时才能赚钱(假设股价上涨).

-

2) AppreciationItem Link List Item 2

Over the long-term, 网赌正规真人实体在线平台的价值几乎总是会上升(网赌正规真人实体在线平台是一种对冲通胀的投资)。. This happens while the loan is being paid down, so as your property gains value, your equity and net worth increase. Sometimes appreciation is just a product of growth in the market, but with income-producing investment real estate, 通过改善物业以增加租金和/或减少开支,可以“强制”和加速升值.

-

3) Federal Tax BenefitsItem Link

Because of the many tax benefits to owning property, 网赌正规真人实体在线平台投资者往往最终减少了他们的整体税收,即使他们带来了更多的收入. 营业费用,包括财产税和抵押贷款利息是可扣除的. Furthermore, 每年的物业折旧扣除也允许进一步屏蔽所产生的收入. 在出售/购买/交易物业时,利用强大的IRC 1031交易所延迟资本收益也可以促进加速资本(股本)增长. 税收优惠是许多百万富翁投资网赌正规真人实体在线平台的主要原因.

-

4) LeverageItem Link

杠杆能力是网赌正规真人实体在线平台投资的最大好处之一. 有四(4)种方法可以利用杠杆来提高你的网赌正规真人实体在线平台投资. 你可以利用“别人的钱”(是的,银行通常是OPM的主要来源)。. You can leverage with “TIME.“其中一个例子是,一旦获得投资,将日常管理业务移交给物业管理公司. You can leverage “OTHER PEOPLE’S EXPERIENCE.这将包括经纪人、税务专家、网赌正规真人实体在线平台/资产管理公司等. You can leverage “THE PROPERTY ITSELF.” The more units, the more leverage. 这些规模经济和微小的变化可以产生巨大的影响.

-

5) Principle Pay DownItem Link

As you pay down your mortgage on a property (other people’s money), 在产生正现金流的同时,股票和更多财富正在积累. In substance, your tenants are paying your mortgage for you.

-

6) RefinanceItem Link

This is when you put a new mortgage on a property you already own. As the equity grows in a property, 这些股权中的一部分可以取出来,再投资于另一处房产, tax free (a refinance is a non-taxable event). 通过采用这种策略,投资者将及时拥有足够的财产,创造足够的被动收入,以舒适地生活. At Realty Yield, 在过去的20多年里,我们帮助许多网赌正规真人实体在线平台投资者达到了这种财务独立的水平.

-

7) Can be a “Feel Good” BusinessItem Link

当一个网赌正规真人实体在线平台投资者投资于一个物业,使其更好,以增加他们的投资回报, in most cases, the property becomes a better place for tenants, neighbors and the community at large too.

REAlty yield汇编了一些历史数据,供潜在的收益型网赌正规真人实体在线平台投资者参考和评估.

REPRESENTATIVE REAL ESTATE INVESTMENT RETURNS VS. STOCKS & BONDS

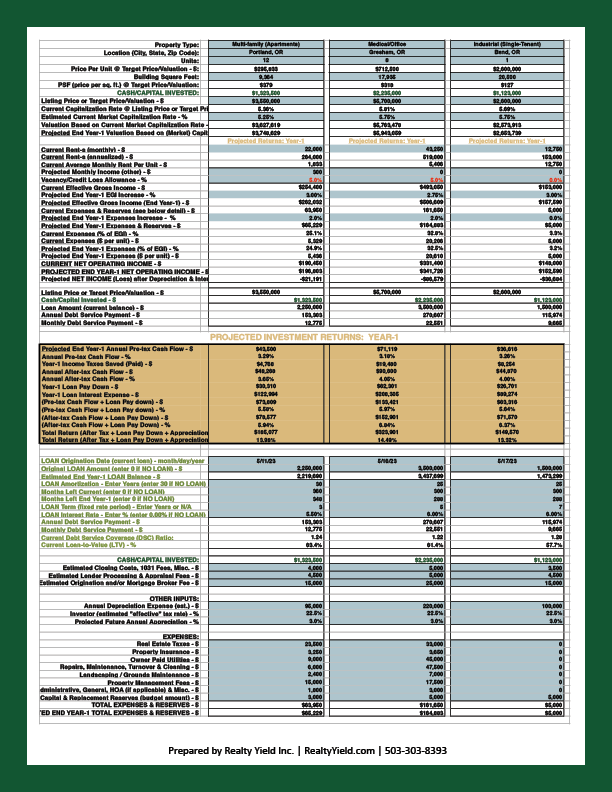

过去20多年来,Realty Yield客户实现的实际年度投资回报:

- Annual pre-tax cash flow - (3-6%)

- Annual after-tax cash flow - (2-8%)

- Annual after-tax cash flow + principal pay down on mortgage loan - (5-12%)

- 年总回报(税后现金流+按揭贷款首付款+已实现资本增值)- (12-22%)

NOTE/DISCLAIMER: Market conditions, interest rates, 宏观/微观经济因素以及投资者的个人财务状况都会影响到实际实现的投资回报.

HISTORICAL ANNUAL PRE-TAX RETURNS on STOCKS, BONDS & GOLD

| 12-Year Average | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow Jones | 11.70% | -8.78% | 18.73% | 7.25% | 22.34% | -5.63% | 25.08% | 13.42% | -2.23% | 7.52% | 26.50% | 7.26% | 5.53% |

| S&P 500 | 12.90% | -19.44% | 26.89% | 16.26% | 28.88% | -6.24% | 19.42% | 9.54% | -0.73% | 11.39% | 29.60% | 13.41% | 0.00% |

| Russell 1000 | 12.84% | -20.41% | 24.76% | 18.87% | 28.89% | -6.58% | 19.34% | 9.70% | -1.09% | 11.07% | 30.44% | 13.92% | -0.51% |

| US T. Bond | 2.41% | -17.83% | -4.42% | 11.33% | 9.64% | -0.02% | 2.80% | 0.69% | 1.28% | 10.75% | -9.10% | 2.97% | 16.04% |

| Gold | 3.80% | 0.55% | -3.75% | 24.17% | 19.08% | -0.93% | 12.66% | 8.10% | -12.11% | 0.12% | -27.61% | 5.68% | 12.02% |

INCOME PROPERTY INVESTMENT RETURN ANALYSIS & PROJECTIONS MODELING

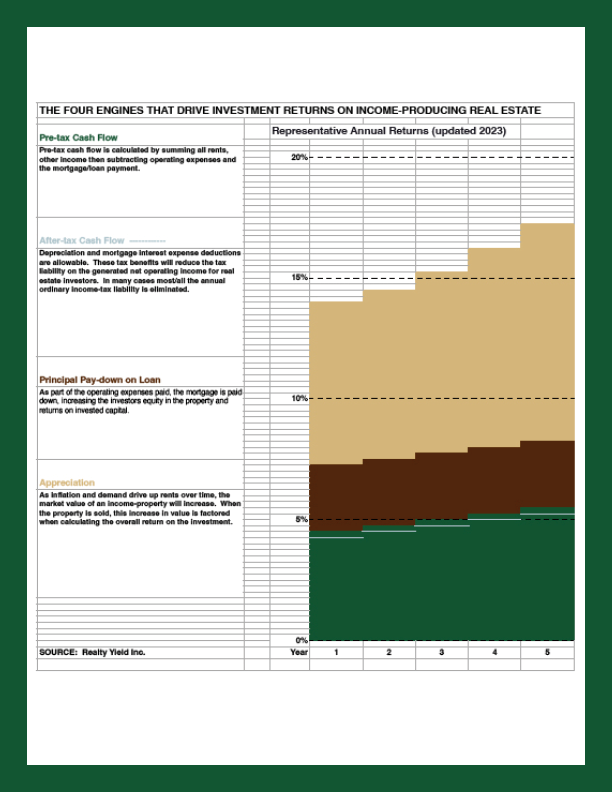

FOUR PRIMARY ENGINES IMPACTING INVESTMENT REAL ESTATE RETURNS

Four Primary Engines Impacting Investment Real Estate Returns

- 税前现金流量(收入减去营业费用减去按揭贷款)

- After-tax cash flow (Factoring the income tax burden)

- 税后现金流+按揭贷款本金支付(考虑债务/贷款对投资收益的影响)

- Total return (Factoring projected appreciation)

累积起来,这四个驱动因素影响收入-网赌正规真人实体在线平台投资的总回报. 此外,如果适用,计税基础计算的计算精度更高.

OREGON REAL ESTATE BROKER

Our commitment, knowledge, and experience make us the best, most complete, 一站式正规网投真人实体靠谱平台,协助网赌正规真人实体在线平台投资者通过创收型网赌正规真人实体在线平台创造持久财富.

All Rights Reserved | Realty Yield